Unlocking Pillar 3a: The Swiss Retirement Tool That Can Boost Your Savings and Cut Your Taxes

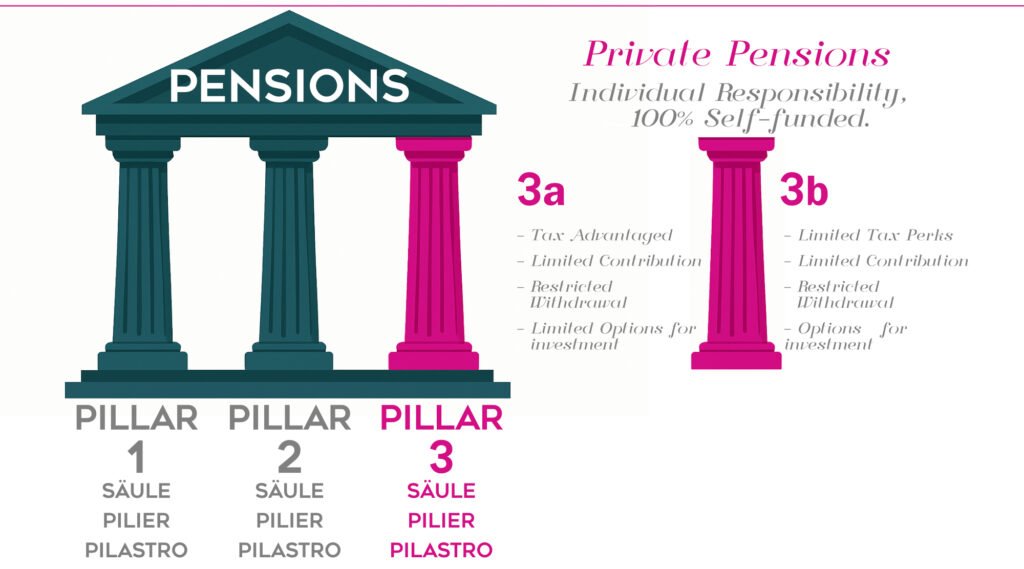

Switzerland is known for many things: stability, precision, and a strong financial system. At the heart of that system is a three-pillar approach to retirement planning. While most are familiar with the mandatory first two pillars, it’s the third one—Pillar 3a—that offers a unique opportunity for individuals to take control of their financial future.

So What is Pillar 3a?

Pillar 3a is a voluntary, tax-advantaged savings plan intended to supplement the mandatory state (AHV) and occupational (BVG) pensions. It allows employed and self-employed individuals to set aside money specifically for retirement, with the added benefit of reducing their taxable income.

The Pillar 3a system emerged from the broader three-pillar pension model enshrined in the Swiss Federal Constitution in 1972. As life expectancy increased and the costs of public pensions grew, the system was designed to encourage personal responsibility and long-term saving. Pillar 3a supports individuals in maintaining their standard of living post-retirement, especially those with higher incomes who might face pension shortfalls.

How Did This Come About?

The Pillar 3a system emerged from the broader three-pillar pension model enshrined in the Swiss Federal Constitution in 1972. As life expectancy increased and the costs of public pensions grew, the system was designed to encourage personal responsibility and long-term saving. Pillar 3a supports individuals in maintaining their standard of living post-retirement, especially those with higher incomes who might face pension shortfalls.

Key Benefits Include:

- Tax Savings: Contributions to a 3a account can be deducted from your taxable income.

- Long-Term Growth: Investment-based 3a accounts offer the potential for higher returns than standard savings.

- Retirement Security: Supplements the other pillars to ensure sufficient income in old age.

Contribution Limits (2025):

- Employees with a pension plan: CHF 7,056 per year.

- Self-employed without a pension plan: Up to 20% of net income, capped at CHF 35,280

Withdrawal Conditions Funds are locked until five years before the statutory retirement age. Exceptions include:

- Purchasing a primary residence.

- Becoming self-employed.

- Leaving Switzerland permanently.

Smart Withdrawal Tip: Since you can only withdraw from each 3a account once, opening multiple accounts can help stagger withdrawals and manage tax impacts better.

Who Benefits the Most?

- Middle to high-income earners: Greater tax savings due to higher marginal tax rates.

- Stable earners: Those with consistent income and manageable expenses can better afford to lock away funds.

- Self-employed individuals: More contribution flexibility and significant deductions.

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore.

When Does It Start Making Sense?

- Becomes attractive at income levels around CHF 50,000/year

- Tax benefits become more substantial at CHF 80,000+

- For lower-income earners, other priorities (debt repayment, emergency savings) may come first

Investment Account or Savings Account

While traditional 3a accounts function like savings accounts, many providers now offer investment options (e.g., ETFs, equity funds) under Pillar 3a. These typically outperform fixed interest over long periods but come with higher volatility.

Pillar 3a isn’t just a retirement tool—it’s a tax strategy, a savings vehicle, and a way to take charge of your financial future. Whether you’re just starting your career or optimizing your financial plan, understanding and using this pillar wisely can make a significant long-term difference.

Thinking of opening or optimizing your Pillar 3a account? In upcoming posts, we’ll explore how to choose the best 3a provider, compare investment strategies, and navigate retirement planning with a holistic view. Stay tuned.

| Country | Equivalent | Tax Deductible | Capped Contributions | Locked Until Retirement | Taxed on Withdrawal |

| USA | 401(k) / Traditional IRA | Yes (pre-tax contributions) / Yes (if income below threshold) | $23,000 (2024) + catch-up / $7,000 (2024) + catch-up | Before 59½ (exceptions exist) / Before 59½ (exceptions exist) | Taxed on withdrawal / Taxed on withdrawal |

| UK | SIPP (Self-Invested Personal Pension) | Tax relief on contributions (up to 100% of salary or £60,000/year max) | ✅ | Funds locked until age 55 (rising to 57 in 2028) | Withdrawals: 25% tax-free, rest taxed as income |

| Germany | Riester-Rente / Rürup-Rente | Limited/ Up to €27,566 (2024) | ✅ | ||

| France | PER (Plan Épargne Retraite) | Contributions tax-deductible (up to 10% of annual income) | Funds locked until retirement (or specific exceptions like home purchase) | ||

| Spain | Plan de Pensiones | Tax-deductible contributions up to €1,500/year (2024) | ✅ | Funds locked until retirement (or serious illness/unemployment) | Tax-deferred growth; fully taxed on withdrawal |

| Italy | PIP (Piani Individuali Pensionistici) | Tax-deductible up to €5,164.57/year | ✅ | ✅ | Withdrawals after retirement age; taxed at a reduced rate |

| Austria | Zukunftsvorsorge & Private Pensionsvorsorge | Zukunftsvorsorge (state-subsidized): tax-free gains, minimum equity exposure | Limited annual contribution (~€2,500 for subsidy) | Withdrawals allowed after retirement (subject to conditions) | |

| Netherlands | Lijfrente (Annuity-based pension savings) | Tax-deductible contributions within a defined “annual margin” (jaarruimte) | ✅ | Locked until retirement, then pays out as an annuity | |

| Belgium | Épargne-pension / Pensioensparen | Voluntary pension savings with 30% tax credit (up to €990) or 25% (up to €1,270) | ✅ | Locked until age 60 (or after 10 years minimum) | Withdrawals are taxed as income |

| Denmark | Ratepension or Aldersopsparing | Ratepension: deferred annuity, tax-deductible contributions. Aldersopsparing: lump-sum savings, not tax-deductible but tax-free withdrawal | Annually, DKK ~63,000–70,000 depending on plan | ✅ | |

| Ireland | Personal Retirement Savings Account (PRSA) | up to 40% of income depending on age | ✅ | ✅ | Withdrawals taxed, 25% can be tax-free |