Resilience and Financial Survival – Lessons from the Great Depression

In an age of remote work, rising living costs, job uncertainty, and side hustles, we’re living through a period of profound financial unease. Inflation is reshaping household budgets, interest rates are climbing, and headlines whisper of recession. For many, there’s a growing sense that something harder may be on the horizon — a fear not unlike what people felt in the 1930s.

But this isn’t the first time ordinary people have had to navigate economic storms. Nearly a century ago, the Great Depression left tens of millions without jobs, housing, or savings. It was a time when the financial system failed, yet people found ways — through resilience, adaptation, and resourcefulness — to survive and rebuild. Their lessons remain strikingly relevant today.

A Glimpse Back: What Was the Great Depression?

The Great Depression began with the 1929 stock market crash in the United States but quickly cascaded across the globe. Banks collapsed. Industrial production fell by over 50%. In the U.S., unemployment hit 25%, and in Germany, it reached nearly 30%. Savings vanished overnight, homes were lost, and breadlines stretched down city blocks. It was not merely an economic event — it was a human one.

What made the Depression so devastating wasn’t just the scale of financial loss, but how deeply it impacted everyday life. Yet amidst the collapse, people adapted. They found new ways to earn, to live more frugally, and to rely on each other. These are the lessons that speak to us today.

How People Survived: Lessons in Adaptation

1. Resilience Through Frugality

The economic hardship forced families to stretch every dollar — or penny. Many embraced practices that today would be considered “extreme frugality.” Clothes were mended rather than replaced. Meals were made from scraps. Leftovers weren’t optional; they were planned. Home gardens — called “victory gardens” — sprung up even in urban areas, providing fresh produce when store-bought food was too expensive.

We see echoes of this in digital budgeting communities, minimalist lifestyles, and the rise of the FIRE (Financial Independence, Retire Early) movement. People are again questioning consumer habits and finding empowerment in simplicity.

“Use it up, wear it out, make it do, or do without.” — Depression-era saying

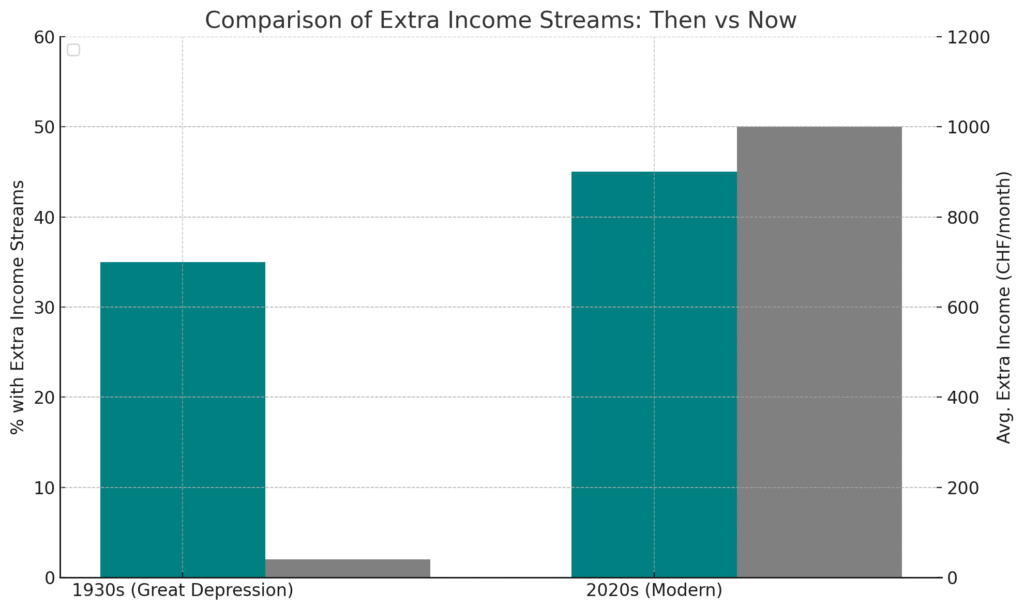

2. Diversification Through Hustles

In a world where steady employment vanished, people found informal, piecemeal work — taking in laundry, sewing, selling eggs, or doing farm labor. Families became micro-enterprises, pooling skills and time to earn anything they could.

The modern side hustle culture, driven by platforms like Fiverr, Uber, Etsy, and Upwork, isn’t just about chasing dreams. For many, it’s about building resilience. The idea that one paycheck is no longer enough — or secure — echoes strongly today. Importantly, people in the 1930s didn’t wait for the system to fix itself. They created income. That mindset remains one of the most powerful financial survival tools.

As we move through this uncertain period, it’s tempting to believe we’re facing something unprecedented. And in some ways, we are. But many of the core challenges — job insecurity, rising costs, economic downturns — are not new.

What we do have today are more tools, more access to knowledge, and a wider range of income opportunities than Depression-era households ever imagined. Yet what they had — resilience, creativity, community, and discipline — remains just as necessary.

History doesn’t repeat itself, but as Mark Twain suggested, it often rhymes. By listening closely to the voices of the past, we can equip ourselves better for whatever lies ahead.

3. Community and Resource Sharing

Economic crisis also strengthened local ties. People moved in together, shared tools, ran collective kitchens, and helped neighbors find work. Informal networks filled the gaps that the state could not.

Whether it’s shared subscriptions, community fridges, co-living arrangements, or financial support circles, the power of collective survival is reemerging. Especially during crises like COVID-19, many rediscovered what older generations knew well: financial resilience is not built alone.

Five Personal Finance Lessons from the Great Depression

1. Adaptability Is More Valuable Than Forecasting

No one predicted the 1929 crash or how long the Depression would last. Those who adapted early — cutting costs, diversifying income — had a better chance of survival than those who held out for things to “return to normal.” The same holds true today.

2. Relying on One Income Source Is Risky

The loss of a single job meant disaster. Today, side hustles, passive income streams, or even small-scale entrepreneurship can act as buffers. Income diversification isn’t just a wealth-building strategy — it’s a survival mechanism.

3. Frugality Isn’t Poverty — It’s Empowerment

Cutting back isn’t a sign of failure. It’s a strategic choice. Those who embraced frugality often came out stronger, having built habits of discipline and value recognition that lasted for life.

4. Save When You Can — Especially in Good Times

People who had even modest savings before the crash were better positioned. Saving isn’t always possible, but when it is, it builds optionality. A reserve can mean the difference between forced decisions and free ones.

5. Community Is a Financial Asset

Networks of support — whether family, friends, neighbors, or online communities — are undervalued financial resources. They help us find jobs, share burdens, and stay mentally afloat. Financial survival is social as much as it is numeric.

A

A

A

A

A

A

| Element | Value | Source |

|---|---|---|

| 1930s: % with Extra Income Streams | ~35% (estimated) | Derived from historical labor studies; includes informal labor by non-primary earners (e.g., women, children, elderly). Based on various economic history research such as “Household Economy During the Great Depression” (U.S. Dept. of Labor, 1930s-40s) and academic works like The Great Depression: America 1929–1941 by Robert S. McElvaine. |

| 1930s: Avg. Extra Income (CHF 40/month) | ~$10–15 USD/month (adjusted to CHF 40 modern equivalent) | Estimated from historical accounts of secondary earnings (e.g., mending clothes, selling eggs, part-time work). |

| 2020s: % with Side Hustles | 39–52% | Based on multiple surveys: |

| – Zapier Side Hustle Report 2023 | ||

| – Bankrate survey (2023) | ||

| – Swiss market equivalents via Deloitte and Credit Suisse Gen Z workforce reports | ||

| 2020s: Avg. Extra Income (CHF 1000/month) | CHF 500–1,500/month | Estimates pulled from Swiss surveys and freelance platform data (Upwork, Fiverr, Uber, etc.). Also aligned with U.S. median side hustle income reported by Statista (approx. $980/month in 2023). |